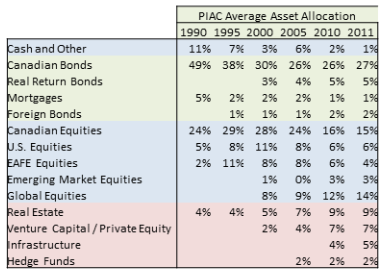

PIAC average asset allocation updated.

Individual investors who use the Pension Investment Association of Canada (PIAC’s) average Pension fund asset allocation as a guide for their own portfolio will notice that the latest updates don’t change the allocations a lot from the previous year or from year to year.

_____________________________________________________________________________________

PIAC is the Pension Investment Association of Canada. Current membership is over 130 pension funds that manage assets in excess of $1 trillion on behalf of millions of Canadians. Members are surveyed annually and the amalgamation results in an average asset allocation of Canadian pension plans. Individual investors who don’t have their own investment portfolio strategy can mimic the PIAC average asset allocation.

Individual investors might also note that the changes year-over-year and over time are in increments. There are no all-in moves from one asset class to another. This may give investors a longer-term perspective when managing their own portfolio – their personal pension plan.

Asset Allocations for the average Canadian pension plan are in the table below. (Also see chart below).

Of interest:

Institutional asset allocation changes move in steps not leaps. Moves are incremental and are, thereby, a lesser risk approach (and cause less market disruption). With a few small exceptions, one-year numbers don’t change much from the previous year. This might be in contrast to what investors read in the daily papers that claim an abrupt swap of one asset for another (at least not by Pension funds). Rather, the pace of asset allocation change is glacial. (Although there may be tactical bets, the absolute size of move is usually limited by good governance and may not show up in aggregated numbers).

Note the diversification across asset class, region and currency spreading risks and casting a wider net across different sources of potential return.

Canada bonds dominate. Investors will have seen headlines that inspire bond panic at the prospect of increased interest rates. Despite those headlines, the PIAC average bond allocation remains at about 1/3rd of the composite portfolio. Bonds provide a match or offset against Pension liabilities. (Bond coupon payments look like the mirror image of retirement income payments). Bonds are the bedrock of most all portfolios. They provide some certainty of return and give the portfolio stability.

There have been, however, changes to the composition of the bond allocation as Pension plans try to squeeze more yield out of this 1/3rd of their portfolio. Many plans have moved into the Provincial and Corporate and High-yield bond space (as well as mortgages) to pick up yield premiums over Canada bonds.

Foreign bonds have had capital growth and enhanced yield opportunities attached to them but they may carry with them currency risk. (Usually US$ or EM Local currency risk. In addition to the usual interest rate and credit risk). So unless foreign bonds are hedged to the Loonie, they are more likely a tactical bet. As an aside, DB plans had nearly zero foreign bonds while DC plans had about 16%.

The Canadian equity allocation is more variable over time. This is, in part, a reflection of the relaxing of foreign content restrictions. (Until 1994 only 10% foreign content was allowed. In 1995 it moved to 20%. 30% in 2001. And 100% in 2005). The reduction in Canadian content also reflects the recognition that Canadian equities make up only 3% – 4% of world markets. And they are volatile. So Canadian equity has been the source of funding for much of the move into foreign equities and Alternative assets in attempt to diversify, enhance income and return and reduce volatility.

Alternative assets can be anything other than stocks, bonds or cash. For the most part they include Real Estate, Infrastructure, Private Equity and Hedge Funds. Again, despite the headlines, the move to the Alternatives space has been measured.

Just under ½ of the Alternatives allocation is Real Estate. This is mostly Canadian real estate that throws off rent income of 4% – 6%. This allocation grew as valuations and income became relatively more attractive. While there are tax hoops for Pension plans to jump through to invest in foreign real estate, that shouldn’t stop Individual investors from adding exposure with a US REIT ETF.

Infrastructure assets appear to have magically appeared in 2010. They didn’t. They’ve been around for years but it simply takes a long time to get fully invested. With some type of Infrastructure assets, cash calls are made as the assets are built … like the 407 highway or Port Mann bridge for example, they are built and require cash over time (years).

Private Equity experienced good growth early in the decade as Pension Plans followed David Swenson’s Yale model. Additional allocations slowed as liquidity became an issue.

When the headlines read Pensions moving to Alternatives, the absolute moves are almost always more gradual and less dramatic. Further, when the larger Pension Plans like CPP or Teachers buys assets, they buy by the $ billion’s. Sure, someone’s going to take note. But $ billion’s is still only 1% of their asset base. PIAC’s 130 Pension Plans moving together is big money but the allocations are added gradually.

Unfortunately, PIAC does not disclose average returns. However, given the PIAC average asset allocations, one can calculate average returns at about 2.8% for 2011. (Using indexes and before fees). For comparison, the 2011 average Balanced pooled fund median return was -1.0%.

PIAC can serve as an asset allocation guide for Individual investors. Guidance doesn’t mean replication. An individual investor’s portfolio does not need to look exactly like the PAIC average portfolio. Approximate or similar will do. And that’s likely to be the performance experience. Missing highs and lows, returns will be middle of the pack (er, average). For many investors, average is comfortable.

References:

Pension Investment Assoc. of Canada (PIAC) (data source). Canada Pension Plan (CPP) Ontario Teachers’ Pension Plan (OTPP) Yale Endowment Fund TD Emerald Balanced Fund returns 2011_____________________________________________________________________________________

Next time? More Risk Management. Doug Cronk CFA is Manager, Investments for a Canadian Pension Plan

Trackbacks & Pingbacks